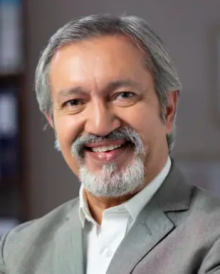

Dr. Pritesh Shah

Dr. Pritesh Shah, an esteemed Professor in International Business Management, holds a Master's degree and over a decade of expertise. Specializing in global market dynamics and cross-cultural management, Dr. Shah is renowned for their engaging teaching style and mentorship. Recognized as a respected authority, they prepare students for global careers.

Dr. Pritesh Shah is an esteemed Professor specializing in International Business Management. Holding a Master's degree in the field, Dr. Shah brings a wealth of knowledge and expertise to academia. With a career spanning over a decade, Dr. Shah has made significant contributions to the study and practice of international business. Their research interests include global market dynamics, cross-cultural management, and international trade policies. Dr. Shah is known for their engaging teaching style and commitment to student success. As a mentor, they provide valuable guidance to aspiring professionals, preparing them for careers in the global marketplace. Dr. Pritesh Shah's dedication to advancing the field of international business management has earned them recognition as a respected authority in their field.